Meal kit services opened up a whole range of new opportunities for consumers. Some people learned to make delicious meals quickly and easily. Some discovered fun and exciting recipes. And some just discovered a new hobby; collecting and never using meal kit coupons that came in the mail (based on a true story).

Since we already covered what's happening in the restaurant and grocery delivery spaces, we decided to close off this trifecta with a study on meal kits. We surveyed a representative sample of 500 Canadians and 500 Americans to understand how they consume meal kits and why they continue to use the service.

Before we dive into the study, we'd like to highlight the work that our friends at Drop did when they tracked the consumption of meal kits throughout the pandemic. According to their report, in January of 2019 consumers weren’t ordering meal kits as often as groceries or restaurant meals. But things slowly started to change as COVID hit - meal kits had a 92% increase in revenue in March 2020. And people still haven't had enough of meal kits today - the average cost per order is still higher than pre-pandemic in Canada and the US.

While Drop's data showed us how things are going from a transactional perspective, we wanted to put the "why" behind the numbers.

In our survey, respondents answered some questions, followed by an idea screening exercise which asked them to swipe right or left on offers that they liked or disliked respectively. The percentage of people that swipes right, that’s their Interest Score. If they swiped right on 2 ideas, they were asked to choose their favourite – that's how we got our Commitment Score. After combining Interest and Commitment, we calculated the total Idea Score, which helps us forecast the success of an offer in-market.

Here's a glimpse into our sample:

Base size: 1000

US, Canada

50% male, 50% female

Adults aged 18+

Let's look at the results step-by-step (see what we did there?).

1. Here's what the most committed customer looks like

Drop's report showed that people order meal kits, on average, 2-3 times a month. So, anybody who orders more often than that can be considered a committed user. But who are those users?

Our survey showed that people who order at least a few times a month are primarily males under 50. Their base income is above $75K per year, and they are likely to live in an urban environment. They typically have a household of approx. 3 people and might have kids.

2. You guessed it: price is the biggest driver of trial for meal kits

We asked respondents why they initially tried a meal kit delivery service. "I got a coupon/discount" was the number one reason, meaning people were attracted by the chance to save money on meal kits. Canadians seem to especially love the coupon aspect. "I got a coupon/discount" got voted 46% in Canada, compared to 36% in the US. Who doesn't like low prices, eh?

The most popular meal kits offer is "More discounts / special sales for ordering more frequently." This offer exceeded all others in Interest and Commitment, making it a winning idea likely to make customers order more meal kits.

But this idea of saving money can also be read differently. 1 in 5 say that they use meal kit delivery services more often today because it "saves money vs. restaurant food." Consumers look for value even when they consider another way of consuming food – e.g., ordering from a restaurant.

If meal kit brands want to attract more new customers, they should consider replicating the idea of value. Whether it's by reducing prices or tweaking their messaging, brands should show that customers get something comparable in value to a restaurant meal.

3. But price isn’t everything: some consumers try meal kits for inspiration

Price is sometimes slightly challenging to shift.

Lucky for meal kit delivery services, consumers told us which aspects of meal kit delivery they find the most important and satisfactory. We then calculated the Importance/Satisfaction score to see if the brand needs to solve any pain points. The higher this score, the more likely people have an issue with an aspect.

The second highest number, at 94, goes to "Exposing myself to new recipes or ingredients." 90% said that it's very or somewhat important, but 86% are satisfied by their ability to try new stuff. This suggests that people who use meal kits to discover new foods and recipes have a problem with that aspect.

We also like to read these aspects of meal kits as jobs-to-be-done (JTBD). . In a nutshell, these aspects are reasons (or jobs) why people use meal kit delivery services. The fact that "Exposing myself to new recipes or ingredients" came top second demonstrates that consumers find it hard to fulfil this job.

Brands should tap into this insight to make the trial experience even more enjoyable. For example, maybe they could introduce more international cuisines or collaborate with restaurants to cook some of their favorite dishes.

4. Customers will eventually order meal kits less often

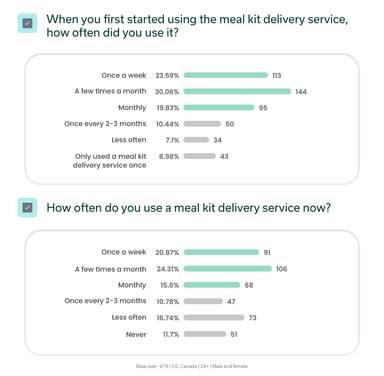

Meal kit delivery isn't the most stable sector when it comes to frequency. We decided to see how adoption compares, from the first time they ordered a meal kit service vs. their adoption today.

74% said they used meal kit delivery services at least monthly. Now this percentage is down to 60%. It shows that there's some softness in the meal kit delivery industry.

We think the issue is that people try meal kits because they get coupons and discounts, as we mentioned before. These promotions tend to end pretty quickly, meaning that customers stop re-upping their ordering going afterwards.

If a brand wants to continue attracting more customers, it should layer another offer on top of coupons and discounts. For example, the second most popular offer in the idea screen is "Same day delivery" (Idea Score 69). Depending on their resources, meal kit retailers can combine this offer with the coupon deal to increase loyalty.

5. New people might hop on board the meal kits train if brands offered special dietary options

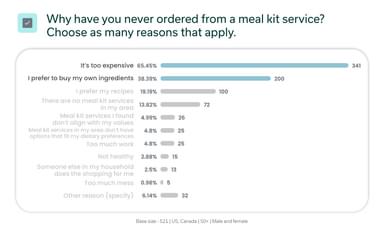

Let's look at people who’ve never used meal kit delivery services.

65% of this subgroup dislikes meal kits because they think they're too expensive. And almost 40% said that they prefer to buy their own ingredients.

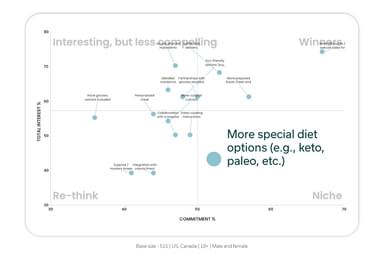

But what offers would entice them to order a meal kit? Well, our quadrant chart showed us some interesting stuff. Upsiide's quadrant chart categorizes ideas (in this case, offers) into four groups, according to the balance between their 'Total Interest' - how many people swiped right - and their Commitment Score - how often they chose a specific offer when pitted against another offer that they liked.

"More special diet options (e.g., keto, paleo, etc.)" appeared in the Niche quadrant, which suggests that it was relatively low in interest, but relatively high in commitment. Usually, this quadrant shows us ideas with high potential for a specific subgroup of consumers. These ideas aren't liked by that many people, but those who like them are really devoted. Super fans, you might say.

The fact that "More special diet options (e.g., keto, paleo, etc.)" is in the Niche quadrant means that there is a subgroup of folks that would be keen to take advantage of a specific type of meal kit offer; one fits into their specific dietary lifestyle. And this offer also aligns nicely with their preference of choosing their own produce – all necessary ingredients are already selected, and they align with their dietary requirements. This offer could allow brands to differentiate themselves from the competition.

6. Americans are especially interested in ‘heat & eat’ meal kit options

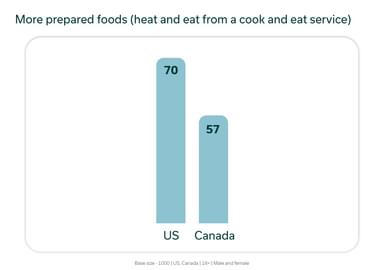

We wanted to see if any ideas performed differently dependent on subgroups. "More prepared foods (heat and eat from a cook and eat service)" showed some action. The US audience rated this idea 70 in Idea Score, whereas in Canada, this number drops to 57.

Whether it's because American consumers find heat and eat foods more convenient or it's just the way they like to eat culturally, it's evident that "more prepared foods" is more prevalent in this country. Brands that want to diversify their range of meal kit products with heat & eat options should consider the US market as a great area for expansion.

To sum up

If you work in meal kit delivery, here are the key takeaways for you to consider based on our recent study:

While price is always going to be the biggest driver of satisfaction and motivation, inspiration is a huge part of why meal kit customers keep coming back

Retention is a challenging nut to crack within the meal kits space, and data shows that people are still dropping off once they’ve adopted a meal kit prover

There could be an opportunity for new entrants to the market, or existing providers that want to expand their footprint: curated dietary options for paleo, veggie, vegan, etc. Lifestyles

‘Heat and eat’ is particularly appealing to US consumers

Want to check out the full food delivery landscape? In this on-demand webinar, data experts at Upsiide take a look at grocery, restaurant, and meal kit delivery trends. Snag your spot now!